Dime Community bank

Tax Document Information

The following tax forms will be available after their estimated mailing date, please sign in to view them.

WHEN TO EXPECT YOUR TAX DOCUMENTS

| Form(s) | Description | Expected Mailing Date |

|---|---|---|

| 1099-INT | The 1099-INT form reports the combined interest of your deposit accounts. If your deposit accounts have a combined interest of $10 or more, this form will be mailed to you. | 01/31/2024 |

| 1099-MISC | The 1099-MISC form reports rent, awards, prizes, and other income payments totaling $600 or more. | 01/31/2024 |

| 1099-R | The 1099-R form reports designated distributions from IRA, Roth IRA, SIMPLE IRA, SEP-IRA, and QRP accounts. | 01/31/2024 |

| 1098 | The 1098 form reports consumer mortgage interest totaling $600 or more. *If your loan is serviced by DMI (Dovenmuehle) please visit www.yourmortgageonline.com. | 01/31/2024 |

| 5498 | The 5498 form reports contributions from IRA, Roth IRA, SIMPLE IRA, and SEP-IRA accounts. | 05/31/2024 |

HOW TO FIND YOUR TAX DOCUMENTS ONLINE

Step 1: Sign into your personal online banking account.

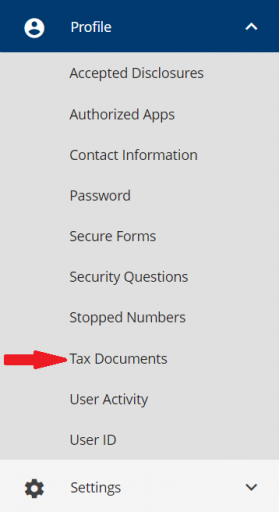

Step 2: Click on the drop down arrow next to your name in the top right corner of your browser, or from the Menu option in the app.

Step 3: Click on Profile.

Step 4: Click on Tax Documents.

All tax documents available will be present on this screen.

Important Information Regarding Multiple Tax Forms

To view this information, please click on the download button below.

DIME COMMUNITY BANK AND ITS AFFILIATES DO NOT PROVIDE TAX, LEGAL OR ACCOUNTING ADVICE. THIS MATERIAL HAS BEEN PREPARED FOR INFORMATIONAL PURPOSES ONLY, AND IS NOT INTENDED TO PROVIDE, AND SHOULD NOT BE RELIED ON FOR, TAX, LEGAL OR ACCOUNTING ADVICE. YOU SHOULD CONSULT YOUR OWN TAX, LEGAL AND ACCOUNTING ADVISORS BEFORE ENGAGING IN ANY TRANSACTION.